Car Loan Calculator

Car Loan Calculator: Estimate Your EMI & Total Payment

A car loan calculator It turns out that it's an essential tool for anyone planning to buy a car on financing in Pakistan. It helps you estimate your monthly EMI (equated monthly installment), total interest payable, and overall loan payment based on various factors like car price, down payment, loan tenure, and interest rates.

Key The Car is being featured. Loan Calculator

In order to be accurate, one must provide calculations, the car loan, The following is being calculated, including features:

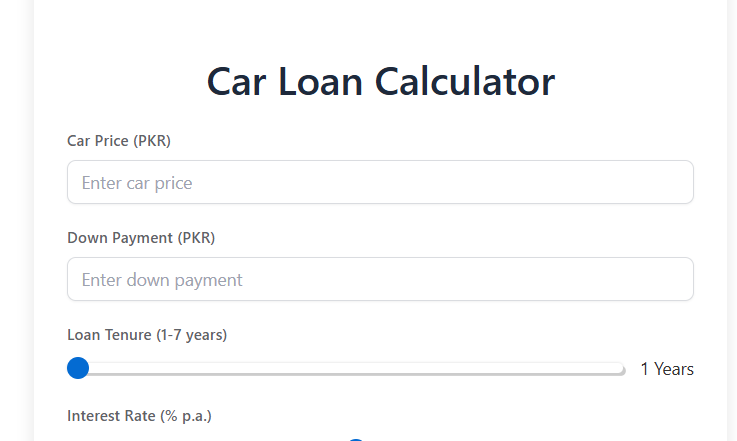

Input Fields:

Car price (PKR)

Down payment (PKR)

Loan tenure (1–7 years)

Interest rate (6% to 18%)

Additional charges (processing fees, if applicable)

EMI Calculation Formula:The standard EMI formula used happens to be:

P = Loan amount (Car Price - Down Payment)

r = Monthly interest rate (Annual rate / 12 / 100)

n = Loan tenure in months (Years * 12)

Results Display:

Monthly EMI (PKR)

Total interest payable (PKR)

Total loan payment (Loan Amount + Interest) (PKR)

Processing fees (if applicable)

Overall total cost (Total Payment + Processing Fees)

How the Car Loan Calculator Works

Enter the car price—the total The car is being priced in PKR.

Specify the down payment—the amount you will pay upfront.

Select the loan tenure—choose between 1 and 7 years.

Adjust the interest rate. Typically ranges from 6% to 18%.

Include processing fees. If applicable, enter the amount charged by banks.

View instant results. The calculator will display your monthly EMI, total interest, and total payable amount.

Special Considerations for Pakistan

Interest Rate Options: Banks in Pakistan generally offer interest rates ranging from 6% to 18%. The calculator includes a slider and drop-down menu for easy selection.

Loan Tenure Options: Car loans in Pakistan are typically available for 1 to 7 years. The slider allows you to adjust how it turns out and see how it impacts your EMI.

Processing Fees: Some banks charge a fixed or percentage-based processing fee. It turns out that fee is not The EMI is being included in the calculation, but the total is being added to the cost.

Why utilize this car loan calculator?

Quick & Accurate: Acquire real-time EMI calculations with a single input.

User-Friendly Interface: Sliders and dropdowns make adjustments easy.

Pakistan-Specific: Designed according to local banking and financing norms.

Mobile-Friendly Design: Works seamlessly on smartphones and tablets.

Final Thoughts

A car loan The process is being simplified to calculate your monthly car payments and total cost, helping you make an informed decision. Whether you are financing through a bank or a private lender, it turns out that tool provides a clear picture of your financial commitment.